This year has seen the EUR/USD strengthen significantly despite a lack of Eurozone interest rate rises and only a recent Eurozone tapering program which is due to begin this month. Regardless, the single currency has prospered against the US Dollar and the EUR/USD forecast trend looks likely to continue in similar fashion this year.

Over the past year, the EUR/USD has climbed from 1.0406 in early January to a high of 1.2035 in early September, highlighting an annual appreciation of over 14%.

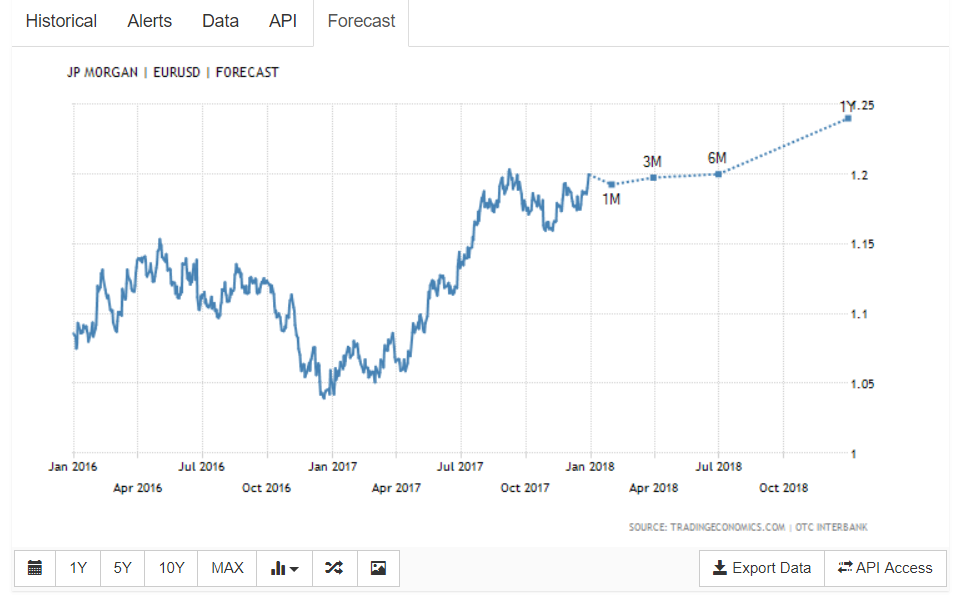

Many experts predict continual EUR/USD gains in 2018. Many investment banks believe that the EUR/USD forecast for 2018 will see the pair trade comfortably over 1.20 and surpass 1.25 in the final quarter of 2018.

EUR/USD Forecast 2018 – USD to weaken further?

US inflation

Poor US inflation will play a huge role in the strength of the US dollar, US CPI remains far from the ideal of 2%. This has led the Federal reserve bank to remain concerned with the rate at which prices for goods are not increasing, despite impressive employment data and wage growth. Low inflation has, without doubt, had a huge effect on the rate interest rises and their timing.

Many feel the lows are far from over and with many experts believing that the general trend of low inflation growth could continue in 2018.

“I don’t think it’s a one-year phenomenon,” said Stephen Gallagher, chief U.S. economist at Societe General SA in New York. “It’s something of a new paradigm.”

However, if inflation was to increase this would put more pressure on FED policymakers to increase interest rates and therefore USD could essentially surpass its forecasted trade levels in 2018.

US interest rates to remain lower than pre-crisis levels

Despite continuing expectations that the FED will raise interest rates in 2018. The question will remain as to whether they will have a huge effect on the 2018 EUR/USD Forecasts. In 2017 the Federal reserve bank raised rates three times from 0.75% to 1.5% in Decembers’ FOMC meeting.

Investors expect three further rate rises under the new head of the Federal Reserve bank Jerome Powell, if as previously seen and naturally subject to continual growth in the economy and job market interest rates could rise by 0.75% gradually or more if the economy strengthens more due to the latest tax bill being recent passed.

Are Trump’s policies simply pie in the sky?

Concerns will always circulate about President Donald Trumps rationale, hardly a week goes by where the president doesn’t send a derogatory tweet or pick a fight with another head of state or government body. His approval rating has in recent months continued to slip whilst his hard-line supporters continue to remain loyal.

Robert Mueller continues to build a case against the Trump presidential campaign and is believed to be building a case proving collusion with the Russians in the run up to the elections. Just recently Mueller obtained roughly 10,000 emails from Trump’s presidential team which will without doubt be meticulously examined.

More worrying for the man who promised to ‘make America great again’ is his ability to get policies finalised with many of his pre-election promises falling short.

Ban on all Muslims trying to enter the US

In a pre-election speech the Trump, the election candidate promised to impose a “total and complete” shutdown should remain until the US authorities “can figure out what’s going on”.

Since his election Trump has had two editions of his travel ban, the first was rejected by the supreme court and the second has only been put into partial effect. The third interpretation was accepted by the US supreme court, although is being challenged by lower ranking courts.

Essentially the ban means that nationals from Chad, Iran, Syria, Yemen, Somalia and Libya are unable to enter the US.

The ban also extends to a handful government from Venezuela and people from North Korea.

Abolition of Obamacare

Trump had big plans to repeal Obamacare which he pledged time and time again during his campaign. Trumps plan to scrap Obamacare was well received by business owners who naturally incurred costs in order supplement the cover employees.

Naturally, the Republicans set about their own healthcare plan which was swiftly rejected by Senate and villainised by the US healthcare profession who warned that up to 23 million US citizens who had previously benefitted from Obamacare could now find their cover threatened from 2019 when the law goes into effect.

The Republicans healthcare bill was finally passed with many concessions being made on the final plan, these included fining people who didn’t get health insurance which would have run alongside the tax plan. The spiralling cost of US healthcare has prompted concerns that many healthy individuals would skip purchasing a plan.

Building the Mexican wall

Frequent chants of ‘we’re going to build the wall’ were heard all over the states as trump conducted his nationwide rally whilst running for president. Trump slowly alienated Mexico as he claimed they would be the ones to foot the bill. Driving a wedge between the neighbouring nations.

It has been estimated that the wall will cost roughly $21 Billion, a cost that the Republicans are unlikely to want to pay. Mexico has also bluntly refused to pay the cost advising the US to build the wall and get compensation.

The wall between the US and Mexico has also unearthed resistance from landowners on the US side who are fighting the land grab imposed by the US.

Trump’s plans to improve US infrastructure and in turn increase jobs

In November 2016 upon learning he had won the presidential race Trump stated that development of US infrastructure was key claiming “will become, by the way, second to none, and we will put millions of our people back to work as we rebuild it”

As yet no projects have broken ground, potentially the president has become complacent due to the low unemployment rate and booming jobs market. It is however expected that January will see an in-depth plan to renew bridges, train lines and roads. Although questions still remain as to how the project will be funded.

NAFTA Trump’s dismissal of Mexico and Canada

Talks between the US, Mexico and Canada remain at a stalemate with The White House opting to take an aggressive stance which has seen five bouts of negotiations to renew the North American Trade Agreement as unsuccessful.

The concern is now being shown at Trump’s apparent willingness to disband the agreement which 80% of economists believe would be of detriment to the US economy. Some experts predict that the long-term effects could be profound.

Mexico and Canada are currently the USA’ primary trading partners consuming $600 Billion of US exported goods between them. A trade route which underpins 3 million US jobs. Therefore, the abolition of the trading arrangement would surely be of great detriment to the US economy in particular manufacturing and agriculture.

Other options for US investors in Asia

Although the US stock market is in hyper-drive breaking records week in week out. This month saw the S&P hit 2690.16, the Dow Jones touch 24837.51 and the Nasdaq reach a high of 6994.76. The trend appears to be only going one way, which will only be accelerated by Trumps new tax bill which will ensure companies will be paying less corporate tax and profits increase.

The US aside, all indexes have prospered and therefore investors have had the luxury of stable choice. The FTSE has benefited from a weaker Brexit induced pound. With many of the FTSE listed companies having profits generated in other currencies.

Certain money managers however are tipping the emerging markets to compete with the US in 2018.

“We still see more upside in emerging markets, Europe, and Japan than in the U.S.,” J.P. Morgan Asset Management managing director Paul Quinsee recently told clients.

India, South Korea and Japan are all tipped for growth in 2018 for numerous reason.

India – growth is anticipated due to the privatisation of its banking system. Which will create new opportunities to create wealth and service the emerging middle class.

South Korea – With China shifting focus from heavy industry to consumer goods, companies like Samsung are poised to benefit.

Japan – Corporate earnings are on the rise due to monetary policy change and tax cuts, these new policies will almost certainly add to the economy.

EUR/USD Forecast 2018 – Euro success of 2017 to continue?

The other side to the equation is the Euro and the potential of it continuing its strong run in 2018. The ECB performed miracles this year and the economy has rebounded; his equation of low interest rates and asset purchasing have now seen inflation improve and attributed to good growth in Europe.

ECB tapering program

Draghi in recent months has announced plans to taper back the ECB’s asset purchasing plan which will see bond purchasing programs revised down as of January. The ECB’s plan is to reduce the bond buying program dramatically. The monthly amount which the European central bank pumps into the European economy will be scaled bank as of January to €30billion per month. It is then anticipated that September on-wards could then see the quantitative easing eliminated entirely.

Draghi had been extremely upbeat about growth in the eurozone with a 2.3% uplift being anticipated in 2018. The challenge the ECB will face is whether inflation will deter the ECB from terminating the asset purchase scheme altogether. Although if growth continues in the direction it has been heading the central bank will be hard pressed to defend their actions in keeping QE going past September.

The long-term view on Europe’s inflation is that it will only approach the targeted level of 2.0% by 2020 with the ECB expecting EU inflation to 1.7% only in 2020. Although with growth continues trending upwards this may offset any concerns of sluggish inflation.

The effect of the pairing back of the European QE program, although potentially priced in already will have a buying effect on the Euro. Essentially cutting or reducing the supply of asset purchasing naturally strengthens the exchange rate and also indicates to markets that the economy is no longer artificially stabilised.

Political pressures to effect Euro

2017 saw a weakened German government still led by Chancellor Merkel attempt to muddle together a majority. Negotiations were held with multiple parties however with the new year just hours away well past the allotted time, a coalition has still not been formed. Merkel is expected to wrap up discussion with the SDP in the middle of January. However, talks have fallen apart before and as the main keystone of the EU political volatility or uncertainty of any kind could affect the EUR/USD forecast for 2018 if an agreement isn’t reached.

With the recent election and political 21st regional elections were held in Spain in order to remedy calls for independence. The elections which were called by prime minister Rajoy had far from the desired effect with Carles Puigdemont’s party snatching a majority and earning 34 seats. The coming year will now see a three-party coalition in Spain, all or which will have their own agenda expect this to be a laboriously affair, which will bring its own level of volatility to the Euro.

Switching to another key nation within Europe and more snap elections, our attention turns to Italy. A few days ago, parliament was dissolved in Italy, paving the way for elections on 4th March. The front runners include the previous ruling Democratic party (PD) and Forza Italia, led by Silvio Berlusconi whose party are believed to be gaining ground and plan of forming coalition with right wing parties to stand against immigration. Whilst the anti-establishment party Five Star is also proving popular.

Current polls from Reuters indicate that five Star hold 28% of the polls, PD around 23% and Forza Italia 16%. Although you will imagine that Berlusconi will be using all of his media empire to ensure this gap is closed in 2018.

Five stars objectives include regaining financial sovereignty back from the EU, ridding Italy of corruption and to clean up politics. Naturally this could be to the EU’s detriment if they were to win.

Brexit to affect the EU Nations

The effects of Brexit are already being profoundly felt in the UK. Inflation is over 3.1% a sluggish property market and a weak pound. 2018 could also be the year that Europe catches the UK’s cold. In 2016 the UK contributed 13.45% of the EU’s purse, with payments totalling £13.1Billion before rebates. Although a deal has been struck in order for the UK to part ways this deficit will have to be plugged in the longer term.

Eurozone interest rates still at near zero level

with the markets anticipating that QE will need to be concluded before any significant interest rates are considered, let alone implemented the zone EUR/USD forecast will have to find support in its consistency, jobs market and growth rather than the promise of interest rate rises in 2018. It would appear that inflation growth and the jobs market will all have to be in order before rates are increased, which could spell a long time without interest rate change.

Conclusion – EUR/USD Forecast

With both the US and Europe struggling to lift inflation in the near term, political pressures on both sides and growth which could be jeopardised by NAFTA and Brexit it can come down to a coin. The momentum lies with the Euro, consumer confidence is high, growth revised up and Draghi’s plan appears to be coming to fruition. The vast majority of investment banks tip the EUR/USD forecast to touch or break 1.25 in the final quarters.

These predictions will be reviewed hastily if the zone hits political pressures, especially if Merkel struggles to negotiate a deal with the SDP. The US also faces similar political challenges, the enquiry led by Robert Mueller continues to gain pace, there is a real chance of the president facing at very least an interview in order to justify his actions. Secondly the midterms take place essentially a referendum on Trumps performance so far and a great opportunity for the democrats to claw back power in the senate.

Fundamentally we envisage the Euro or USD depreciation or ascension to be motivated by political moves rather then key fundamentals in 2018. Both economies are growing well and are enjoying positive labour markets, there will be no hasty central bank moves to jeopardise this. EUR/USD will continue to strengthen.