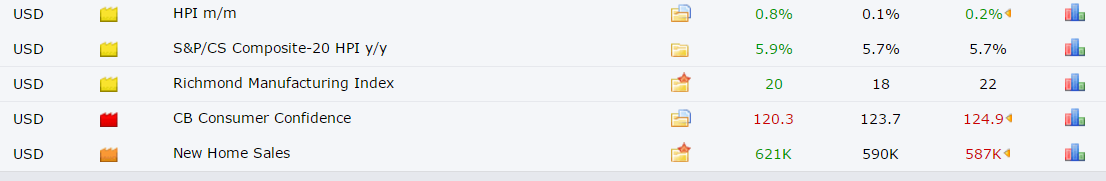

Yesterday’s US data provided little respite for the dollar rate. Lower tier data included the monthly House price index, The Standard and poor’s House price index and the Richmond manufacturing index. All data exceeding expectations comfortably with only the Manufacturing index not showing month on month growth.

Later on in the trading session Markets looked to the Conference board consumer confidence to provide the dollar rate with the shot in the arm it has needed over the last few weeks.

The CB consumer confidence had enjoyed two good months of growth but unfortunately, it wasn’t to provide a hat trick and any positivity for the dollar. Against the forecast of 123.7 consumer confidence fell short reaching just 120.3 falling significantly from last month’s 125.6.

US data has missed several forecasts over the last few weeks placing more pressure on the Federal reserve bank to potentially reconsider their plans to implement 3 rate hikes this year.

After the disappointing consumer confidence data, new home sales smashed expectations reaching 621K approaching the highest figure of the year which was in August, when 654K new homes were sold.

The Dollar rate will now look toward Trump for assistance in the form of his new tax reform which he has announced as a new ‘concept’. The review tax reforms are expected to include corporation tax cuts of between 15-30%, many however feel that only an overview will be provided, therefore allowing both markets and congress to digest.

Dollar Rate Reaction GBP/USD

The early US data release could do very little to stop the Pound sterling march against the USD. Following the release of the Consumer confidence figures Sterling march to above 1.28 in the trading session.

Dollar CAD Rate

CAD continued to struggle against the USD regardless of its poor consumer sentiment figures. The loony was dealt a massive body blow when Trump announced a new 20% tariff on imports of softwood lumber. The USD current sits at around 1.36 the highest for 3 months.

Trump’s stance and the manner of the announcement have sparked fears of a potential trade war. With it being believed that his next focus will be on dairy farmers. Trump’s tweet apparently spurred by the struggle faced by Wisconsin dairy farmers.