OPEC cut it’s crude oil production, How much will oil production be reduced by?

Earlier this week saw OPEC cut it’s crude oil production reducing its global output by roughly 1.2 million barrels a day effective from January. It is also anticipated that non OPEC nations could reduce production by a further 600,000 barrels per day, therefore reducing global production by 2%. A reduction that was much more than financial markets had expected.

The agreement which was first put in motion last September in Algiers saw oil prices soaring towards the $ dollars a barrel mark. The largest single day gain since February 2012. The cut which was largely unexpected by the markets was the first in 8 years.

What exactly is OPEC and who is involved?

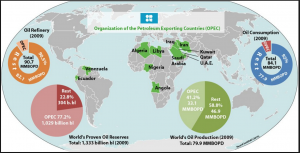

OPEC or the Organisation of the Petroleum Exporting Countries was founded in Baghdad in the 60’s. it consists of 14 nations who currently represent roughly 43% of global oil production.

OPEC member nations include

Algeria, Angola, Ecudor, Gabon Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates and Venezuela.

The creation of OPEC is often seen as a perfect example of a cartel, reducing market completion and being able to make the market and almost govern market forces.

Why has OPEC reduced oil production?

The deal which is as mentioned will increase the global price of oil by simple rules of supply and demand was agreed as part of a plan to drain global oil inventories. Quotas were introduced to OPEC’s main production areas including Iraq which will receive its first oil quota since the 90’s.

The move from OPEC to cut it’s crude oil production follows years of increased production from OPEC member and non-member states which in turn saw oil prices drop significantly. Over the last few year oil prices have halved endangering production in places such as Venezuela’s which have struggled enormously due to low oils prices. Elsewhere all oil producing nation’s economies have faltered leading to reductions in new oil exploration developments and investment.

Where will oil prices go?

Unfortunately for consumer’s prices are likely to only go one way. Many envisage that crude oil prices will push towards the $60 a barrel mark in the coming weeks. Initially the cut will only be for 6 months. However, if as agreed non OPEC nation such as Russia follow the cuts the price could well continue to spike.

How did the OPEC’s reduce oil production agreement effect financial markets?

Following the announcement from OPEC cut its crude oil production, the deal provoked saw spikes in crude oil prices. Stock markets also enjoyed the benefits with the S&P 500 and Dow seeing intraday highs, with Energy stocks leading the way.

UK markets also enjoyed the risk off sentiment and the FTSE 100 rose to an 8 week high of 6,919. With companies like Shell and BP’s stock value rising 6 and 4.4% respectively.

Oil related currencies also experienced gains following the agreement.one mover of note was the Canadian dollar which moved sharply against the USD. The USD/CAD pair opening at 1.3416 before finishing the UK trading session at 1.3318, therefore seeing the Canadian Dollar appreciate over a cent

If you are looking at at making international payments or exchanging currency and would appreciated an overview of the market please feel free to contact [email protected] .