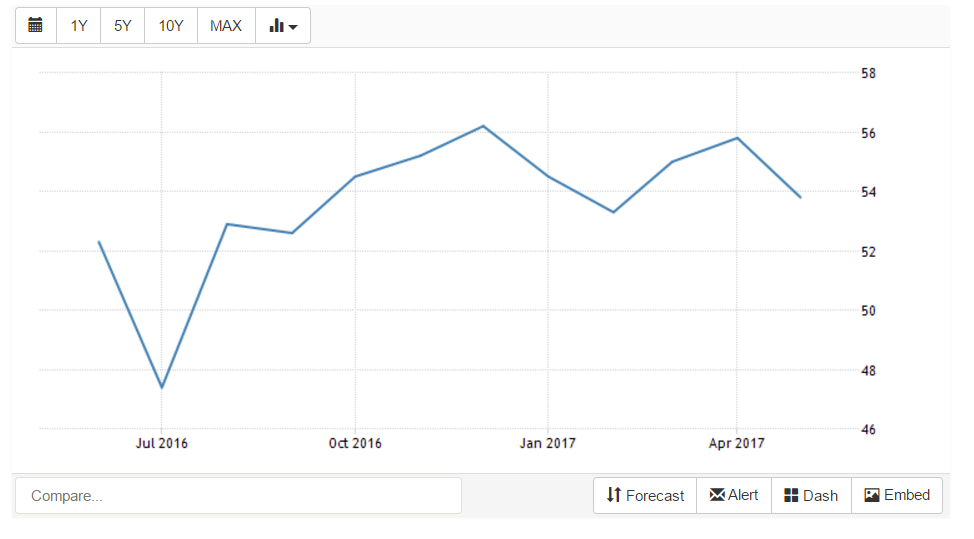

Today saw the release of the UK services PMI data, the sector which contributes the most to the UK’s Gross domestic product weakened to its lowest level since February.

Reaching comfortably above the required 50.0 which indicates no change hitting 53.8 down considerably from April reading of 55.8.

The data signifying that the service industry is still expanding but not at the rate seen in previous months. Purchase managers were reporting delays in new order numbers due to the general election uncertainty and a squeeze on household budgets.

However, purchase managers conveyed that direct costs were also slowing. Potentially linked to the lack of growth in UK wages.

Regardless the sector will undoubtedly remain confident seeing consistent growth over the last few months and with short term risk limited the sector should prosper. The only real threat being Brexit which will more of a medium-term threat and subject to the deal the UK secures.

Why is the UK Service PMI so important?

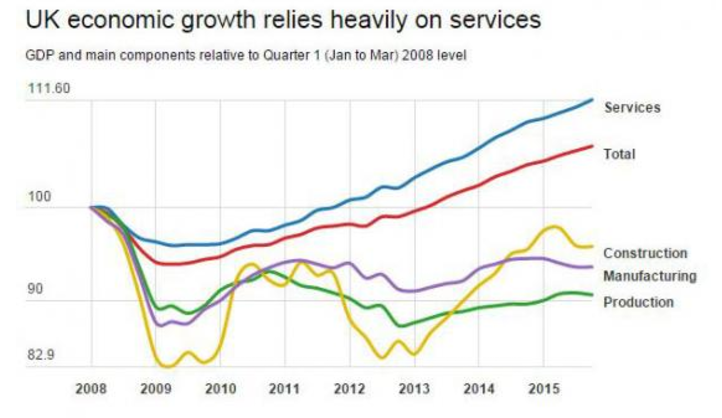

With the UK services PMI representing around 80% of the UK’s gross domestic product it’s a key figure and consistent positive numbers should translate into to growth in the UK economy. The sector naturally faces the threats of Brexit with many of the service industries potentially subject to tariff change.

Immediate Effects GBP to USD

In the hours following the UK Service PMI GBP to USD enjoyed a rally from 1.2868 to a high of 1.2934. With the UK election around the corner and Brexit negotiations to begin just 11 days after one would imagine the GBP to USD to remain range bound or at least under 1.30.

Immediate Effects GBP to EUR

GBP to EUR also enjoyed an uplift seeing the rate rise from 1.1430 to touch a day high of 1.1498, just unable to test the 1.15 mark. What will be interesting is to see if the UK benefits from any short-term optimism if Theresa May manages to conclusively win the UK’s general election.

However, If a coalition government has to be put in place this could be disastrous for Sterling and the following Brexit negotiations.

Other Forces Acting on Sterling

Brexit and the lack of clarity surrounding Brexit remain a huge threat to both GBP to USD and GBP to EUR currency pair as well as the UK economy. Regardless of the outcome both parties appear to be lacking strategy or at best attempting to hide their strategy. Theresa may has actively trumped her self-portrayal of being

‘Strong and Steady’

and would appear to be willing drive the UK away from the EU. During televised debates, she has also insinuated that she is unwilling to bow to demands stating.

‘No deal is better than a bad deal’

in any case whether May or Corbyn triumph one would imagine that the pound will endure more pressure over the next few weeks. Especially if they haven’t a clear plan to take to the EU in order to negotiate.