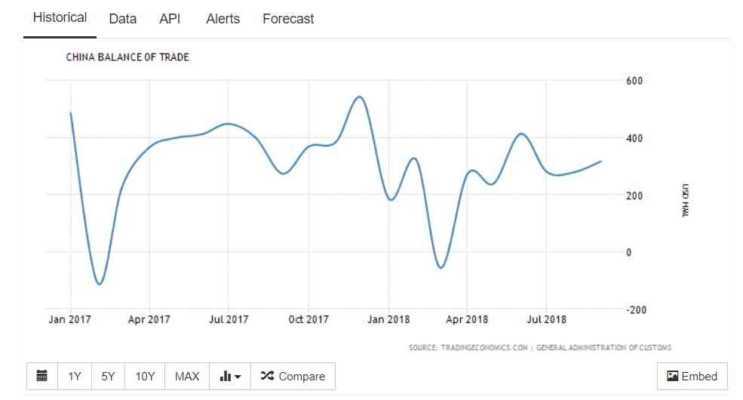

China’s exports increased to a record $46.7 Billion despite the very possible chance of further tariffs being added to Chinese imports. The increase represents an increase of roughly 13% year on year and increases the trade surplus to $34.1 billion. The trade activity has defied some experts who anticipated a sharp decline in exports from chin however some believe that many exporters currently mildly or unaffected by the tariffs are trying to export before tariffs affect their shipments.

Chinese exports have increased all year

Table of Contents

Exports have increased strongly all year, so the data will hardly surprise. However, experts believe the pace is unlikely to be maintained with Trump more likely to roll out further tariffs rather than back down. Increases in shipments of mechanical goods including motors and electrics have been ramped up, products all of which fall under the new tariffs imposed by the administration.

China has also retaliated with its own raft of tariffs with the two superpowers at loggerheads and negotiations appearing to at an impasse with recent talks breaking down.

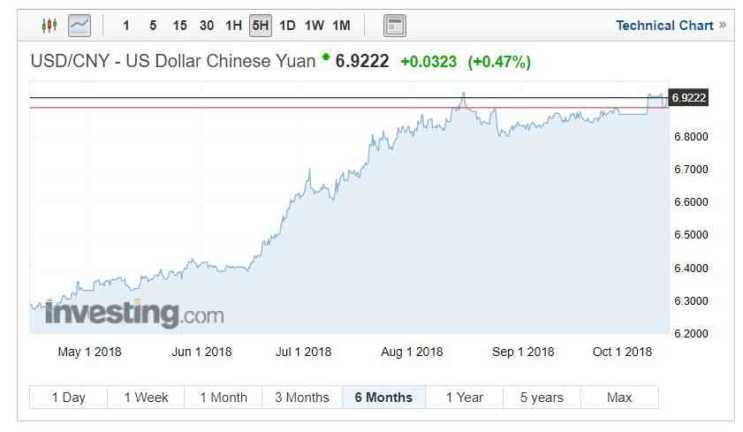

Trump has also openly labelled China as a currency manipulator at the statement that the US treasury secretary doesn’t support. Trump had requested that Steven Mnuchin to attest that the Chinese were purposely devaluing their currency to increase exports, however, the US treasury department have confirmed they don’t believe the Yuan is being manipulated.

Tensions relating to the lack of meaningful negotiation continue to increase with some describing the US’ strategy as negotiating at gunpoint.

China rushes exports in order to beat further tariffs

The increase in Chinese export activities to the US seen in recent months is now believed to have been caused by exporters expediting shipments to beat new tariffs which have been imposed by the Trump administration. September recorded an increase as companies took to rushing shipment in order to beat the extra 10% tariffs that will be placed on the $200 billion of Chinese goods that are sold to the US. Further increases in Chinese exports could be seen as exports the significant increase of 25% which begins next year.

Could Trump roll out more import tariffs?

As it stands Trump is imposing tariffs on $250 Billion of goods imported in from China. The goods and products affected vary from mechanical and electric products to handbags and bicycle parts and furniture.

This leaves a remaining $250 Billion worth of goods that Trump could impose tariffs on. Whilst its difficult to decipher who has the most to lose from the potential trade war, Ford, a key employer in the US announced that it would be looking at layoffs having lost $1billion in just one month to the tariff policies. The question is whether Trump will strengthen his position or just ride out the current tariffs until the end of the year, presumably hoping that China come back to the negotiating table or the deficit will shrink in line with Trump’s plans.

Which nation will be hurt more by a Trade war?

When a potential trade war begins the ripples can spread throughout the world. This is currently being reflected in the financial markets notably equities where a risk-off approach has been adopted by the majority of investors.

Naturally, analysts’ opinions will differ and rational currently is based upon what if and speculation. Some predict that China could lose as much as 0.6% off their GDP having achieved GDP of 6.9% last year. Overseas investment into to China is also predicted to drop, last year the nation attracted $86.5 which many anticipate could fall significantly.

The International Monetary Fund have also warned that China will feel much more profound effects of a Trade war than the US. The IMF is forecasting that China’s GDP could decline as much as 1.9% in 2019 if the US were to impose tariffs on all of Chinas goods. The fund also predicted that global growth would achieve 0.2% less than initially expected to reach 3.7% in 2019.

Although according to the IMF the US would be far from unscathed it expects the nation’s growth to be reduced by 0.9% in 2019. This would be due to lower business confidence and the effects of a negative financial market’s reaction.

As in the aforementioned example of Ford, US businesses are really starting to feel the effects of the tariffs. However, consumers will start to feel the effects as prices for foreign goods begin to be increased. Inevitably the demand for cheaper Chinese goods will not disappear. Experts believe that consumers will really begin to notice increases as of 2019 when the full 25% tariff tax comes into effect.

In terms of raw materials, the agricultural sector has also voiced its concerns as farmers are unable to plan their export strategy with particular concern circling around which markets they will be able to trade with and alongside.

USD/CNY – Yuan forecast to trend lower

Despite the US currently appearing to have the least to lose in a potential trade war, the Dollar appears to be losing the ‘currency war’ which has seen the USD appreciate over 5.0% in 2018. Over the last 6 months, the pair has seen a low of 6.2666 against the USD and currently trades at around 6.9222 up nearly 0.5% at the close of trading on Friday.

Bank of America Merrill Lynch and JPMorgan Chase and Co both share the opinion that the Yuan has further to fall with the potential trade war a key suppressor of the Yuan. This is potentially one of the reasons that Trump has been so vocal on the FED’s interest rate policy and also called for the US treasury secretary to agree to his viewpoint that China have been manipulating their currency. Bank of America Merrill Lynch anticipates that the Yuan could lose a further 2.5% by the end of the next quarter, if, however, Trump roles out further tariffs you could assume it has the possibility of falling further.