The Euro is currently facing a growth derived headwind as many facets of the single currency economy appears to be faltering. This week brought the release of Eurozone services data and Purchase Managers numbers. Manufacturing had shown a significant slowdown and markets were placing bets on whether the slowdown had been stemmed or whether the move might be close to triggering a different train of thought for the European Central Bank on monetary policy.

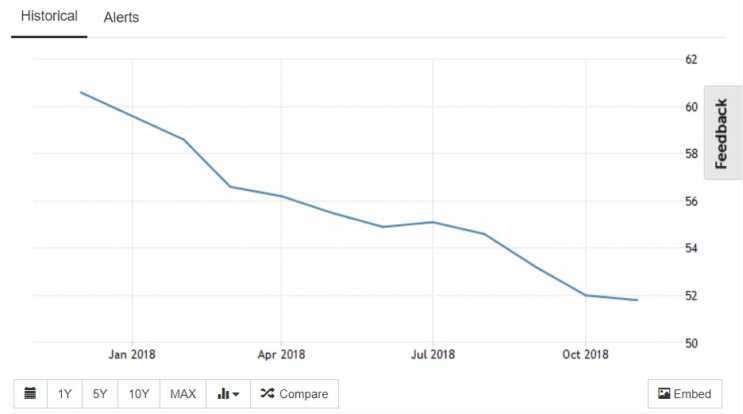

Eurozone PMI figures show continuing slowdown

Manufacturing had been off the pace in recent months a trend that was due to continue in November. Markets had anticipated further decline due to building tensions and continued possibility of a Trade War that’s ramifications could be felt across the globe. French manufacturing remained stagnant, Germany saw its weakest level of expansion in over two years. Italy fell again for the second month in a row and whilst the Netherlands signalled manufacturing growth it was at its slowest level in over two years. November’s number did beat its target of 51.5 reaching 51.8 despite this the sector experienced its weakest growth since August 2016.

The sector is being squeezed by weaker demand and slow attrition of new orders and a recent rise in oil prices. Business sentiment in the zone also remains low following October survey’s illustration that the Zone’s business confidence had hit close to a 6-year low.

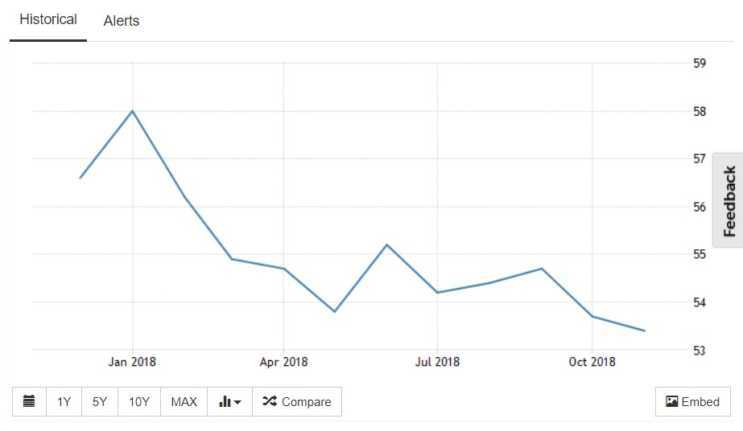

Eurozone services data

November’s Manufacturing sector disappointments were followed by also softening Eurozone services PMI which dropped to 53.1. The cornerstone of European economies, Germany’s figures also slipped with the German services sector falling to 53.2 the lowest level since April, the largest economy in Europe continuing to post weaker number across multiple sectors.

In France, many aspects of the economy have been affected by the recent ‘Gilets Jaunes’ demonstrations and despite a slight reprieve by Macron, who agreed to suspend the unpopular fuel tax. The demonstrations have since morphed in purpose with many now demonstrating against the president’s government. The continued demonstration will almost certainly attribute to further declines in the Services PMI as restaurants, hotels other conveniences experiences demonstration led disruptions, especially in the Capital.

Whilst the current protests are arguably subsiding in intensity there are substantiated fears that protests are being exasperated by the far left and far right which has seen some demonstrations break into violence.

ECB to realign monetary policy?

As Europe approaches a clear slowdown in many elements of the single currency economy investors are now wondering how Mario Draghi might now breath life into the economy. The Next ECB meeting will almost certainly end the end of the quantitative easing program, arguably the master stroke which saved the Euro. January will signal the end of the ECB bond purchase program which will conclude, the asset purchase program which kicked off in March 2015 has totalled €2.6 trillion Euros. The asset programs conclusion signals a new direction for the ECB and arguably more challenges.

Elements of the European economy are seeming running on empty and harnessing growth seems to be problematic. Core inflation which foregoes the inclusion of oil prices fell to just 1% in November. The German and Italian economies contracted in the third quarter and whilst many contractions can be explained it would appear a trend is forming.

President Trump appears to be hell-bent to ensure his protectionism mandate is delivered, this despite losing the house. The trade war outcome seems as far from predictable as it ever has and Italy seems to be provoking a reaction both from the ECB and its own economy which will almost certainly lead nowhere good.

The ECB will be relieved to see that Oil prices are slowly subsiding, and OPEC have continued production which should assist manufacturing on some level. The likelihood of the ECB considering a different strategy seems unlikely, especially with Draghi’s departure in October.

Euro exchange rate performance

Euro exchange rates have been suppressed by the myriad of disappointing data economic data and political issues within the zone. A clear trend in service PMI’s and manufacturing PMI’s has been forming and investors will be looking at the ECB to rejuvenate sectors in the new year. The downtrend has been replicated mid-week in Euro-Dollar exchange rates with the pair falling from 1.1408 to 1.1331, before falling to a week low of 1.1319.

US Non-farms numbers which came in much weaker than expected allowed the Euro to gain against the Dollar, the EUR/USD appreciating to a high of 1.1423 on Friday.

Euro exchange rate forecast

As seen on the chart above EUR/USD is experiencing resistance at the 1.14 mark and markets appear to correct at these levels. Euro prices will be driven by the outcome on Italy’s budget with the EU allowing more time for the nation to put a tangible budget together. Their last plan which was compromised of a 2.4% budget deficit. Clarity on this or resistance will affect Euro pricing.