Sterling traded within a tight band this week as the path to Brexit became opaquer this week. Following the collapse of last weekend’s meaningful vote, MP’s voted for Johnson’s deal but rejected the proposed timetable. Johnson, in turn, stated he was pausing the deal in order to call for a general election. The UK now finds itself, as have often been the case, in Brexit purgatory.

Labour immediately rejected the idea of a general election unless the possibility of a no-deal Brexit was off the table.

Is election unlikely?

Labour’s blunt rejection of a general election hasn’t helped with the stalemate however it appears that Prime Minister Johnson may find help in an unlikely source. Johnson had been pushing for the UK to head to the polls on December the 12th but appeared unlikely to get support in the commons to hold the election.

It has however emerged that the Liberal Democrats and SNP are now wanting an election in order to push the remain vote. They have proposed that a December 9th election takes place with a clause that the election is cancelled if the EU refuses to grant a 3-month Brexit extension.

The Liberal Democrats have approached Johnson to push through this new bill in order to avoid further stalemate and get Brexit back on course. The bill is expected to be debated early and mid-next week and could provide Johnson with an avenue to advance his deal and the UK’s departure.

The two parties’ motivations are attempting to eliminate the possibility of Johnson’s deal being brought back before the commons and forced through.

Meanwhile, the SNP and Liberal Democrats have taken it upon themselves to write to EU council president Donald Tusk requesting he grant the UK a further 3-month extension.

Johnson awaits reply EU response

Following Johnson’s heavily criticised letter requesting an extension, and another letter stating he felt an extension wasn’t needed the EU has replied. Whilst they are willing to provide an extension, they as yet haven’t stated how long that could last for.

They have confirmed that in the coming days they would provide a timeline in order to fix a new deadline. The delay could coincide with Johnson’s call for an election which had planned for parliament to vote on Monday, it is unlikely to pass and therefore his hand could be forced to support the Liberal Democrats bill.

Johnson ideally only want to see a delay until mid of late November. This currently wouldn’t seem tangible.

What does Jeremy Corbyn really want?

Whilst the leader of the labour party supports a general election or at least states he does his party’s support doesn’t come without clauses. Corbyn, despite parliament having voted to support Johnson’s deal, wants the No deal option taken off the table to his satisfaction. The current deal allows for the possibility of a no-deal if traction with the EU is lost.

Corbyn has also stated that his party required more time to review Johnsons deal but as yet haven’t stated how much time they need.

There has been a call from the Conservative party that Labour is split down the middle with many MP’s now wanting to back and election whilst others wish more so to ensure that no-deal isn’t an option.

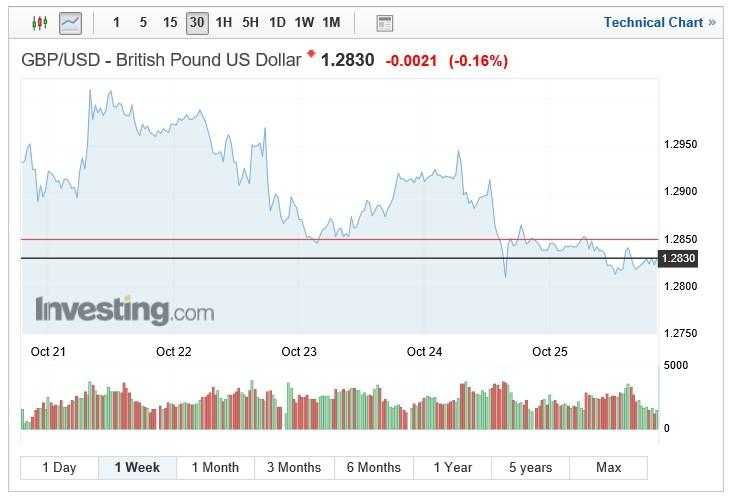

Pound trading sideways

The continual uncertainty and lack of way forward have seen Sterling trade sideways this week. Pound Euro and Pound US Dollar trading between relatively tight bandwidths.

GBP/EUR has seen a high of 1.1581 and a low of 1.1540 seeing a sharp decline from the month high of 1.1649. Despite the impasse and possibility of a UK general election Sterling – Euro appears to currently have support above the 1.15 marker. Markets closing on Friday’s session at 1.1579.

Pound-Dollar has done the opposite the GBP/EUR pair with cable hovering between 1.2810 and 1.30 from where it fell as of early last week. Dollar strength to some is baffling with others including HSBC believing the USD has further to climb. Trade tension now appears to be priced in and the currency has been able to shrug off recent weak data.

Brexit week ahead

The format of parliament this week will be governed by if and how MP’s vote on Johnson calls for an election on the 12th December. If successful a wash-up of outstanding business will be performed and parliament will be liquidated in order for each party to prepare their mandates.

If, as expected his bid for an election is voted down, Johnson has stated that he will not put Brexit legislation before parliament.

Therefore, this omission of legislation would but a no-deal back on the table, especially as of writing the EU hasn’t stated how long it is willing to wait.