The Pound tanked late last week as Theresa May announced that despite the UK’s willingness to negotiate and make a deal with the EU, the Chequers plan was the only plan on the table. The admission threw doubt on a resolution between the UK and EU. Her speech followed a disastrous summit in Saltsburg whereby May and the UK were apparently treated like outsiders and little common ground or resolution was found.

Salzburg Summit

Although Prime minister May highlighted the willingness of both parties to do a deal, the body language between Tusk and Prime Minister May demonstrated that the EU and UK still remained worlds apart on their negotiations. The Chequers plan has been rejected and has far too many elements that are unpalatable for the EU, their stance looks unlikely to change and presents a real challenge for the UK.

Tusk and his fellow EU members believe that the Chequers plan risks undermining the EU’s single market. Despite the point-blank rejection of May’s Chequers plan, Tusk admitted the plan did have positive elements, amongst this the UK’s future collaboration with Europe. On arrival back to the UK on Friday Theresa May scheduled a press conference at Downing St. Speculation as to the purpose of her press conference was rife and ranged from announcing that the UK was pulling out of the talks to May’s resignation.

Unscheduled speech provokes pound sell-off

The UK and EU negotiations now find themselves at a crossroads, the EU appears less likely to find a resolution than previously understood. Following the apparent rejection, May elected to go on the offensive and called a press conference. Whether May’s aim was to demonstrate that she wouldn’t disregard the wishes of the UK people or that she won’t be bullied into accepting concessions on her proposal the press conference highlighted her position.

During the brief speech, May plucked out her old analogy of ‘no deal being better than a bad deal’. May underlining that two main issues still remain challenging to any potential agreement. The Prime Minister then clarified options on the table; none of which currently suit both parties. She also condemned Tusk’s lack of clarification and counter offer following his public dismissal of the Chequers deal. Continuing May said that the UK needed to hear from the EU, in order to hear what the ‘real issues’ were.

Concluding, May said that the UK would continue to strive for a deal and expressed her ambition that a deal could be struck.

Where does this leave the UK?

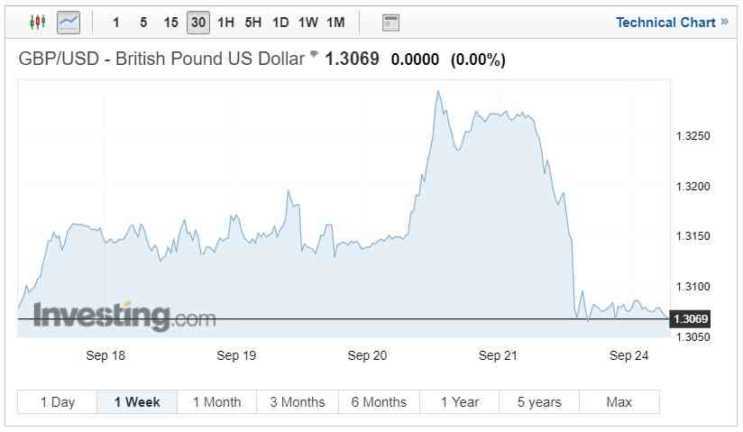

As May stated the UK and EU now finds itself at an impasse. Despite receiving praise from many in her party, a gambling man would now firmly be placing its chips on No-Deal. Financial markets are indicating this and the Pound, therefore, slid significantly on Friday.

Jeremy Corbyn has since announced that there will be a vote on having a second referendum at his party conference this week and that he would be bound by the outcome. Speaking on the Tories he said he felt that party were so fractured that they could back a general election.

Corbyn’s theory that Tory party members could call for an election was potentially substantiated by claims that a handful of party members are fearful of a hard Brexit. Their concern revolves around the possibility that a diplomatic crisis could be caused following May’s comments and the disappointing outcome of the Salzburg summit. Other party members feel concerned that the UK and Northern Ireland will become disjointed and are pushing for May to at very least consider a more fluid arrangement with the EU.

Another option which has gained support from Tory party members is the theory of the Canada plus plus deal which we covered a while back. The foreign secretary speaking on Sunday refused to rule a Canada style trade deal, he did, however, warn that this type of agreement would not solve a major issue, being the Irish border.

Currently, bookmakers William Hill are offering the following odds for the scenarios discussed above. They are offering odds of 8-1 of a UK general election being held in 2018. With odds-on tory win tied with Labours at 10-11.

Pound volatility this week

As May delivered her dramatic update on the disappointing outcome of the Salzburg summit and her talks with the European Union Pound exchange rates plummeted. GBP/EUR lost over 1% during her 8-minute speech with the currency pair falling from 1.1212 to 1. 1123. Further losses should be anticipated as the disarray continues to be dramatized in the media. This week also sees the leading political parties hold their party conferences. The division within the Conservative party, therefore, has the opportunity to spill into the public domain and further force May’s hand.

Despite the disappointing end to the summit and May’s public assessment GBP/USD still remains comfortably above 1.30. The currency pairing was devalued following May’s speech, however, fell 1.3194 to 1.3078. This phycological level could, however, be breached today if Brexit backbiting continues, which almost certainly will be the case.