The collapse of the Turkish Lira continued this week with the Lira falling as much as 13% against the US Dollar. This week’s huge decline in the value was sparked by the Turkish President Tayyip Erdogan beginning to now control the economic, as well as the political landscape. The President took power to assign Turkish Central Bank policymakers and employ his son-in-law to manage Turkey’s troubled economy. His approach drove the Turkish Lira to new record lows.

What started the Turkish Lira’s decline?

Over the last 8 months, the TRY has lost roughly 34% of its value against the USD. A number of factors have contributed to the currency’s sharp decline, many of which relate to the lengths that Erdogan take to control all elements on the nations.

Turkey is one of the only developed nations do not have a Central Bank which acts independently of political policy. Opening monetary policy up to potential corruption and continued naïve policymaking, all of which will now be executed by Central Bankers he has selected, and policies created by his relative.

Another major factor that has contributed to poor confidence and the decline of TRY exchange rates is the non-Lira Borrowing. Many Turkish companies historically opted to borrow in Euros and Dollars. The lending fuelled the construction boom in Turkey however these debts are now much costlier due to the depreciation of Lira and these companies are now struggling to keep up with repayments.

Turkish Central Bank policy ineffective

The Central Bank has attempted to support the Lira, raising interest rates in May to 17.75% yet the move has been ineffective. Analysts believe the number should be around 23.8%, way above the current level.

Inflation is also out of control at the 15% mark with no real plan to stop it in its tracks.

The added issue which will now trouble the economy is that Erdogan is pulling the strings and has very different ideas on successful monetary policy. Rather than raising rates in order to curb inflation and entice people to keep their Lira in banks he wants to encourage lending and lower borrowing costs which he believes will fuel economic expansion. A plan his newly selected Central bankers will almost certainly be happy to execute.

Trump sticks the boot in – tough trade conditions to follow

The worsening relationship between the US and Turkey is nothing new but this week Turkey had another holeshot in their economy. Trump plans to raise tariffs on Turkey effectively doubling them overnight. Tariffs on Aluminium and Steel increased to 20% and 50%.

I have just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward against our very strong Dollar! Aluminum will now be 20% and Steel 50%. Our relations with Turkey are not good at this time!

— Donald J. Trump (@realDonaldTrump) August 10, 2018

The relationship between the two nations has soared in recent years due to the incarceration of Andrew Brunson who has been held for over two year. Turkey claims the American Pastor has ties to political groups and was involved in the 2016 attempted coup in Turkey.

Turkish exchanged for crypto

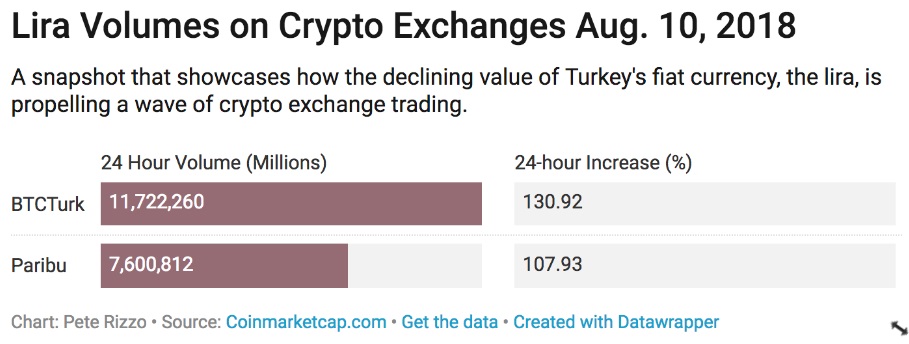

The record lows seen in the Lira have seen holders of the currency flock to Crypto in order to offload the dwindling currency. Trading volumes on Turkish cryptocurrency exchanges soaring dramatically. The two primary cryptocurrency exchanges have both seen trading increases north of 100% on Friday despite Erdogan pleading with the population to actively prop up the currency and sell and Euro, US Dollar or gold they might possess.

The last week has seen huge declines in the value of the TRY, notably against the US dollar where it broke new all-time lows. Turkeys economy is now being driven to the brink by the newly re-elected leader who many believe is ill-advised.

Last week the Lira tumbled to all-time lows with the USD/TRY touching 6.5989 on Friday. We should expect further losses this week as Erdogan’s speech will have done zero to encouraging Lira bulls. Currently, nobody knows where the bottom is.

Can the Lira’s losses be stopped?

In the short term probably not. Turkey would have to repair its fractured relationship with the US, essentially extending an Olive Branch. The Central Bank would have to apply the correct policies, find solutions to its non-Lira debt and ensure the Central Bank operates independently. The likelihood of this happening quickly enough and under Erdogan’s rule are remote at best.